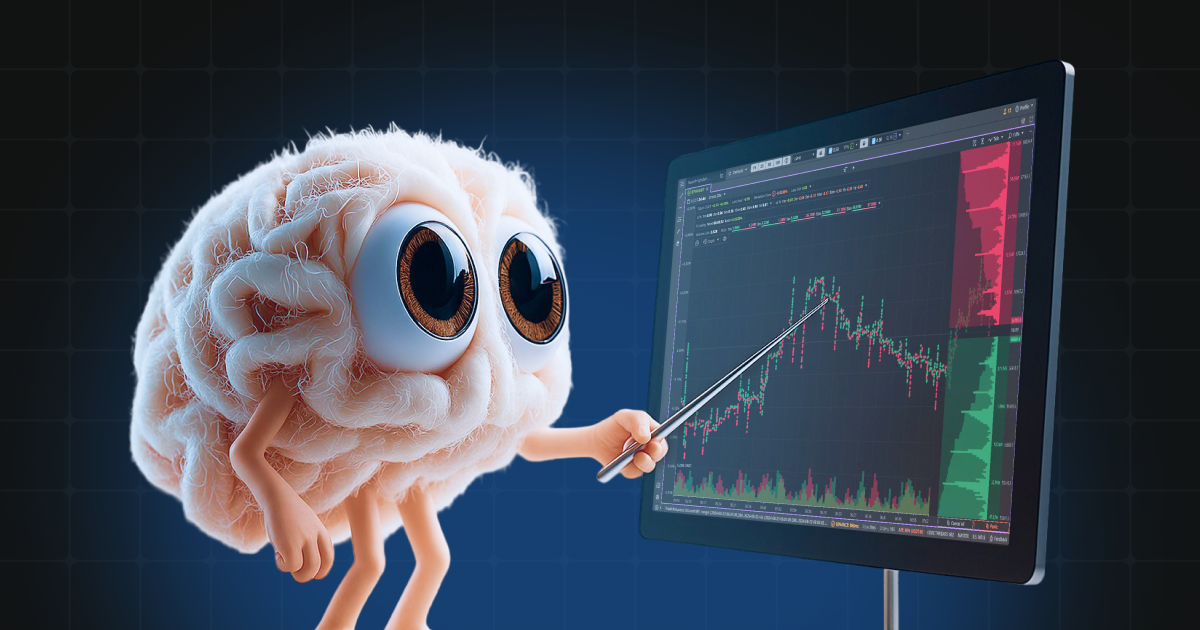

Scalpers often notice that a candlestick chart shows only the background but not the actual sequence of trades. As a result, entries or stops may look “random.”

The reason is simple: candlesticks are time charts, aggregating price over fixed intervals, which masks important micro-movements.

A tick chart in trading works differently. Instead of time, each bar forms after a set number of trades. This way, you see the real order flow — the “heartbeat” of the market. For scalpers and day traders, this makes it one of the best chart types for scalping strategies.

In MoonTrader, the tick chart is implemented with low latency and a cloud archive — combined with other terminal features, this makes it not just visualization but a powerful trading tool.

What is a tick chart?

Candlestick / time chart:

📊 Screenshot 1. Tick vs candlestick in the same trade

On one-minute candles only the overall background is visible, while the tick chart shows price dynamics more clearly — allowing a precise capture of the start of the move.

📊 Screenshot 2. Same trade on a candlestick vs tick chart

The tick chart reveals micro short spikes and price compression at the level before the drop — invisible on the candlestick.

For scalpers, a tick chart trading setup can be game-changing. Unlike time charts, it reacts to real activity, making it one of the best tick chart tools for scalping crypto.

1. Microstructure visibility

Slowdowns, accelerations, reversals, steps near levels.

📊 Screenshot 3. Catching a reversal more precisely on the tick chart

2. Precise entries and exits

You can see where the impulse breaks or stalls. Perfect for scalping strategies that rely on timing.

📊 Screenshot 4. Start of a trend move

3. Anomaly detection

False breakouts and tick spikes that candles smooth over.

📊 Screenshot 5. Local short entry in trend

For algorithmic trading, tick charts are not just a tool for execution but also for post-trade analysis.

📊 Screenshot 6. Post-analysis of a short trade

The tick chart shows that the algorithm could have squeezed more profit with a wider distance.

📊 Screenshot 7. Volatility capture by the Shots algorithm

1. What is a tick chart in trading?

A chart built on each trade or price change, not time.

2. How does it differ from time charts?

Candlesticks smooth movement over time, while tick charts show every trade.

3. Who should use tick charts?

Scalpers, day traders, and algorithmic traders.

4. Why does MoonTrader offer cloud tick history?

For trade reviews, finding strategy flaws, and improving exits.

5. Can you use tick charts and candlesticks together?

Yes — candles for context, ticks for scalping precision.

A tick chart shows the real heartbeat of the market. Instead of smoothing activity into time bars, it reveals the sequence of trades. For scalpers, this means sharper entries; for algorithms, fewer blind spots.

With MoonTrader’s tick chart software, traders gain instant visualization, cloud history, and low-latency execution — making it one of the best tick chart setups for day trading and scalping.

👉 Try trading for a couple of days watching both candlesticks and ticks side by side — you’ll feel the difference.

Check us out on

© 2024 MTSS Development OU, Estonia. All rights reserved.

Disclaimer: Moontrader is not a regulated entity. Trading involves substantial risks, and past performance is not indicative of future results. The profits shown in product screenshots are for illustrative purposes and may be exaggerated. Only engage in trading if you possess sufficient knowledge. Under no circumstances shall Moontrader accept any liability to any person or entity for (a) any loss or damage, in whole or in part, caused by, arising out of, or in connection with transactions involving our software or (b) any direct, indirect, special, consequential, or incidental damages. By using Moontrader's services, you acknowledge and accept the inherent risks involved in trading and agree to hold Moontrader harmless from any liabilities or losses incurred. It is essential to review and understand our Terms of Service and Risk Disclosure Policy before using our software or engaging in any trading activities. Please consult legal and financial professionals for personalized advice based on your specific circumstances.

All trademarks and copyrights belong to their respective owners. MoonTrader ecosystem is a registered trademark of MTSS Development OU, Estonia.